By: Isaac Thornley

This post is a part of our new report, Greenwashing the Ring of Fire: Indigenous Jurisdiction and Gaps in the EV Battery Supply Chain.

[READ THE FULL REPORT]

[READ THE EXECUTIVE SUMMARY]

EV Batteries 101

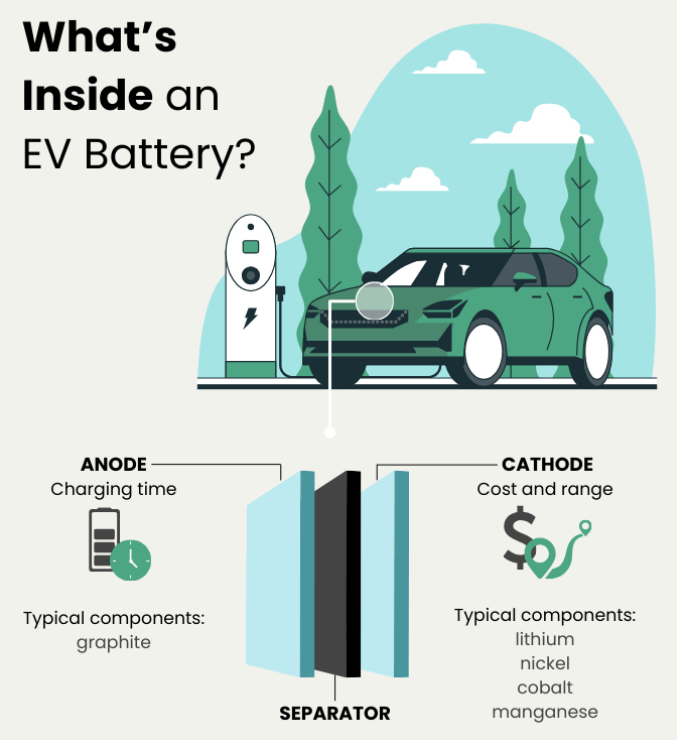

Most EVs currently use lithium-ion batteries for energy storage, the same kind of rechargeable battery used in a smartphone or laptop. EV batteries are essentially a bundle of thousands of smaller battery units or “cells” packaged together. Battery cells are made up of four main parts: the two electrodes (the cathode and the anode), the electrolyte, and the separator.

The movement of charged lithium atoms (or ions) between the anode and cathode, facilitated by the separator and electrolyte, enables the battery to store and discharge electrical energy, providing power to EVs. During discharge, lithium ions move from the anode to the cathode, releasing electrons at the anode. These electrons travel through the external circuit, providing power to the car.

While the anode is mostly made from graphite, the cathode comprises a range of minerals such as lithium, nickel, manganese, and cobalt. The cathode contains the greatest variety of minerals, is the most valuable part of the battery, and is a major determinant in the performance of the battery—including the energy storage capacity, duration of charge, and battery lifespan. There are many different battery cathode chemistries, which involve combinations of different minerals in varying proportions, each of which has pros and cons in terms of cost, availability of materials, mineral intensity, and battery performance.

Battery technology innovation, the development of new battery chemistries, and the uptake of reuse and recycling processes are all factors that will determine how demand for EVs will translate into demand for specific minerals. While battery technology is rapidly evolving—with multiple automakers announcing plans to use a new sodium-ion battery, for example—for the time being, battery chemistries containing lithium remain the most common.

The Use of Nickel

Nickel is one of 31 “critical minerals” identified by Canada, insofar as it has “few or no substitutes,” is a “strategic and somewhat limited” commodity, and is “increasingly concentrated in terms of extraction and, even more, in terms of processing location.” Nickel is also one of the six minerals prioritized in Canada’s Critical Minerals Strategy (along with lithium, graphite, cobalt, copper, and rare earth elements) since it is seen as having “distinct potential to spur Canadian economic growth” and as a necessary input for “priority supply chains.” Canada sees “stainless steel, solar panels, batteries, aerospace, and defence” as the “major applications” for nickel.

In the context of EVs, nickel is a key part of the cathode of the battery cell; demand for nickel is projected to double by 2050., In two of the most common cathode chemistries—NMC (nickel manganese cobalt) and NCA (nickel cobalt aluminum oxide)—nickel is a primary material. NMC is the most used type of cathode chemistry; Trillium Network assumes an NMC cathode chemistry market share of 45 percent by 2030. NMC batteries can be further differentiated by the ratio of minerals in the cathode; e.g., NMC 111 has an equal weight of nickel, manganese, and cobalt.

The market is trending toward chemistries with higher concentrations of nickel, such as NMC 622 and NMC 811, to reduce demand for cobalt and lithium. A cathode using NMC 811, for example, contains 80 percent nickel by weight; in general, most lithium-ion batteries rely on some amount of nickel. Nickel has many material properties that make it a useful part of a cathode, including its high energy density, voltage flexibility, and relative abundance and availability. Cathodes with higher nickel concentrations lead to higher energy density batteries, which allows EVs to travel for longer ranges per charge.

Supplying the New Gigafactories

“O’ Canada, we’re fully charged for thee,” announced Volkswagen in April 2023, following its decision to site its first North American gigafactory in St. Thomas, Ontario, with production set to start in 2027. This was the second major announcement in Ontario, following Stellantis-LGES’ plans to expand its facilities in Windsor. Both firms negotiated massive subsidies (a combined $28 billion) from the provincial and federal governments, the largest ever granted to automakers in Canadian history, after pressuring Canada to align its industrial policy with the U.S. Inflation Reduction Act.

Finally, in September 2023, Swedish company Northvolt announced its plan to site a new gigafactory and recycling facility just outside Montreal, Quebec. Some First Nations and environmental groups oppose the plant, arguing that it is located in an ecologically valuable wetlands environment (which will be damaged by clearcutting the forests), that the government inadequately consulted both the public and Indigenous groups, and that a full environmental assessment is required.

The Office of the Parliamentary Budget Officer (PBO) has released a series of reports on the recent government subsidies,, including an analysis of the “break-even” timeline for when government revenues generated from the new Ontario gigafactories can be expected to equal the subsidies. The PBO concludes that government revenues from the Volkswagen and Stellantis-LGES plants will break even after approximately 20 years, in contrast to Ontario and Canada’s claim that the “full economic impact of the [Volkswagen] project will be equal to the value of government investment in less than five years.”,

This discrepancy hinges upon assumptions about the degree to which other sections of the supply chain (such as mining and EV assembly) will “fill in” domestically and generate economic multiplier effects. In an interview, Parliamentary Budget Officer Yves Giroux highlighted how “the North American automobile sector is highly integrated with activity taking place in the U.S., Canada, and Mexico,” and that the government break-even timeline involves a “leap of faith that there will be all these suppliers appearing in a short period of time” in Ontario and Canada. Despite optimistic government assumptions, there is no guarantee that Canadian batteries will end up in cars manufactured in Canada and contain minerals mined in Canada.

Labour economist Jim Stanford has emphasised the importance of these government investments in safeguarding the jobs of auto workers: “the government is supporting these plants because that is what’s required to maintain the auto industry, and all of the economic and social benefits that it generates, as it transitions to EVs.” According to Stanford, Canada’s auto industry would disappear in 15 years if not for such government subsidies to encourage foreign investment. Commenting on this, Giroux argued that as auto workers transition from producing combustion-engine vehicles to EVs, there will be a “substitution effect” and therefore we cannot assume that all new EV jobs would generate “additional government revenues.”

It has been estimated that the two new Ontario Volkswagen and Stellantis-LGES gigafactories will produce a combined 135 gigawatt hours (or enough batteries for 1.4 million EVs) per year in Ontario for several decades., Quebec’s Northvolt gigafactory will add another 60 gigawatt hours or enough batteries for another million EVs per year. There are many uncertainties about how the new gigafactories will be supplied, the volume of materials required, the origins of the raw materials, the location of their processing and refining, and the distribution of social and environmental inequities along the supply chains in Ontario and Quebec.

Recent reports of excessive levels of air-borne nickel in a Quebec City neighbourhood adjacent to a shipping port, resulting from relaxed environmental standards, has generated criticism over the government’s choice to prioritise the profits of the battery industry over the health of residents. Nickel is carcinogenic in high enough concentrations and examples like this demonstrate the potential environmental hazards and health risks tied to the extraction, refining, and transportation of nickel.

In developing projections of the mineral intensity of EV battery production, it is necessary to make assumptions about factors such as battery size and lifespan, cathode chemistry, and recycling rates while remaining aware that technological innovation and market conditions are changing rapidly (e.g., see Trillium Network’s Battery Content Assumptions table).

Wyloo claims that they can produce 150 thousand tonnes of nickel concentrate per year or “enough nickel to supply about half a million battery electric vehicles on an annual basis.” Wyloo Canada CEO Kristan Straub has further claimed that “it’s going to take… close to 25 to 30 new Eagle’s Nests” in order to supply Ontario’s new battery electric vehicle market. With such massive scales of extraction deemed necessary, it is important to evaluate the environmental promises used to justify these activities and highlight some alternative transportation options.